22 Sep What Does Critical Illness Cover?

What Does Critical Illness Cover?

- Sagar Joshi

- 22/09/2022

What does critical illness cover?

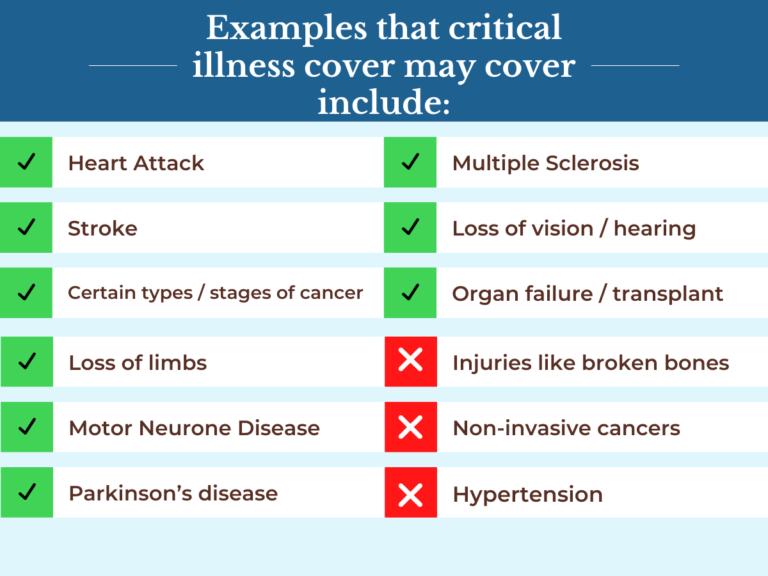

A lot of people have heard of critical illness but don’t know exactly what critical illness covers. Critical Illness Cover is an insurance policy that will pay out a cash lump sum if you’re diagnosed with a serious illness listed in your policy’s terms. The tax-free, one-off payment helps financially support you. For example, to pay for your treatment, mortgage, rent, or home modifications, if necessary.

If you develop one of the specific medical conditions or injuries listed in the policy, critical illness insurance will pay out. It only pays out once, and then the policy expires.

The conditions and illnesses covered by different insurers can vary significantly. However, the most comprehensive policies cover 50 or more conditions, while others are far more limited.

There are many other Illnesses that individual companies cover. Hence, why we recommend going through all documentation to see exactly what individual insurers cover.

Each insurer will also have their own definitions of these illnesses. This effectively sets a ‘threshold’ for how serious that illness has to be before you can make a successful claim.

Is critical illness cover needed?

No one knows whether or not they will suffer from a serious illness. However, a severe illness can strike at any time. Statistics show that the risk of many critical illnesses is increasing in the UK, even among younger working-age people.

Here are some statistics:

- Over 900,000 people in the United Kingdom have survived a heart attack. (British Heart Foundation)

- Secondly, around 1 in 4 new cancer cases diagnosed every year are among people aged under 60. (Cancer Research)

- Almost two-thirds of people currently living with multiple sclerosis are under 60. (Multiple Sclerosis Society)

- Up to 10 percent of all strokes occur in those under age 45.

- Finally, in the UK almost two thirds (65%) of stroke survivors leave hospital with a disability. (Stroke Figures)

Evidently, these statistics show that a lot of people are being diagnosed with serious illnesses than passing away before the age of 60.

It is essential to have critical illness cover in place if you :

- Don’t have enough savings to cover ongoing expenses such as bills, rent or mortgage payments.

- Have financial commitments, such as a mortgage, or dependants.

- Are the main income earner in your family.

However, Critical Illness Cover may not cover every incidence of one of these illnesses. It will all depend on the severity of the illness also, the wording in your policy documentation. Hence, why we tell all of our clients to read and check the definitions carefully.

How much cover do you need?

The amount of critical illness cover you need will depend on your individual circumstances, such as your age and financial situation. It’s important to consider factors such as your mortgage or rent payments, other debts, and ongoing living expenses when determining how much coverage you need. You may also want to consider any potential lost income if you are unable to work due to a critical illness. It’s recommended to speak with a financial advisor to determine the appropriate amount of coverage for your specific needs.

Critical illness cover’s designed to provide a lump sum payment if you are diagnosed with a serious illness such as cancer, heart attack, or stroke. This payment is usually used to cover medical expenses, pay off debts, or provide financial support during a difficult time. If you have dependents who rely on your income, you may want to consider a higher level of coverage to provide for them if you are unable to work due to a critical illness.

References:

- https://eu28.salesforce.com/sfc/p/#b0000000aU6Q/a/b0000000g8Mx/TDpvPM9C7VMY9lxGwcK5cv01iw_5YzlZqTWZ8dDVP2A

- https://www.cancerresearchuk.org/health-professional/cancer-statistics/incidence/age#heading-Zero

- https://eu28.salesforce.com/sfc/p/#b0000000aU6Q/a/b0000000g8RE/a.PvB2Xj9.O7r1g3DVKHblZpo3WenM63MBo_j0MuvSU

- https://www.gov.uk/government/news/new-figures-show-larger-proportion-of-strokes-in-the-middle-aged

No Comments