14 Sep Does Life Insurance Payout?

Does Life Insurance Payout?

- Sagar Joshi

- 14/09/2022

What is the percentage of payout rates?

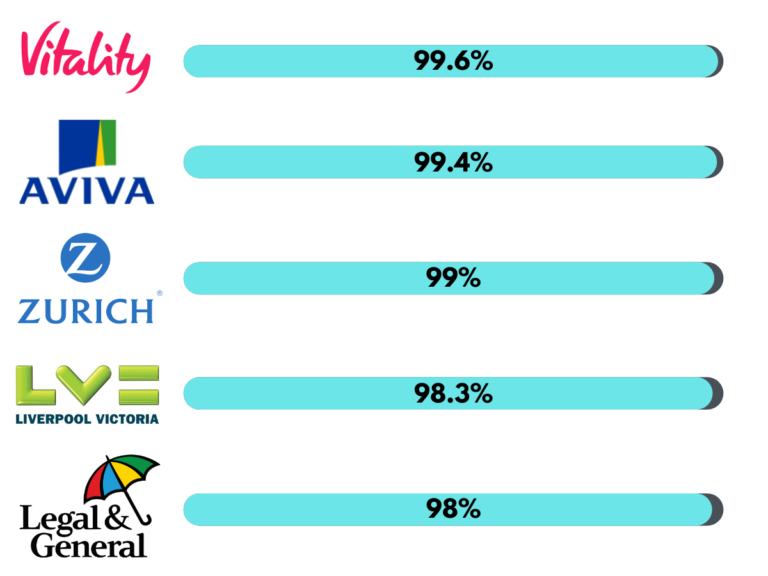

Does life insurance payout? In 2021, 98% of all life insurance claims were paid out. Also, the amount paid out for life insurance claims increased by £349 million compared to 2021, overall, to a total of £3.4 billion.

It’s a common misconception that life insurance companies don’t payout, despite the statistics proving otherwise.

In this article, we’ll look at the payout rates of some of the top life insurance companies in the UK. We will tell you everything you need to know about life insurance payouts.

What are the payout rates for protection products?

Life Insurance

Whole Of Life Insurance

Critical Illness Insurance

Income Protection Insurance

When doesn’t life insurance payout?

If you outlive your policy

The most common reason for a life insurance payout not being made is that the policyholder outlives their term life insurance policy. This type of insurance provides coverage for a set number of years. Your insurer will not payout if you do not die within the term.

If you commit suicide

The vast majority of life insurance policies will refuse to payout if the policyholder commits suicide. This is to prevent people from purchasing policies with large payouts and then taking their own life to help their family pay off their debts.

Hiding information on your application

Non-disclosure is the main reason why an insurance company may fail to pay a claim. When applying, you should answer the questions and make sure they are accurate. Lying about your health and lifestyle may result in a lower premium, but if you ever need to file a claim, it could make your cover completely void. Remember to disclose any high-risk interests you may have, such as skydiving. Your insurer may decline your claim if you die while engaging in any high-risk activities about which they are unaware of.

No Comments