11 Aug Reasons To Review Your Life Insurance

Reasons To Review Your Life Insurance

Why You Should Review Your Life Insurance Policy

Life insurance is an important protection product that can provide financial security for your loved ones in the event of your death. However, as your life circumstances change, your insurance needs may also change. Conducting a life insurance review can help ensure that your policy is still meeting your needs and that you are getting the best value for your money. In this guide, we’ll walk you through why you need a life insurance review.

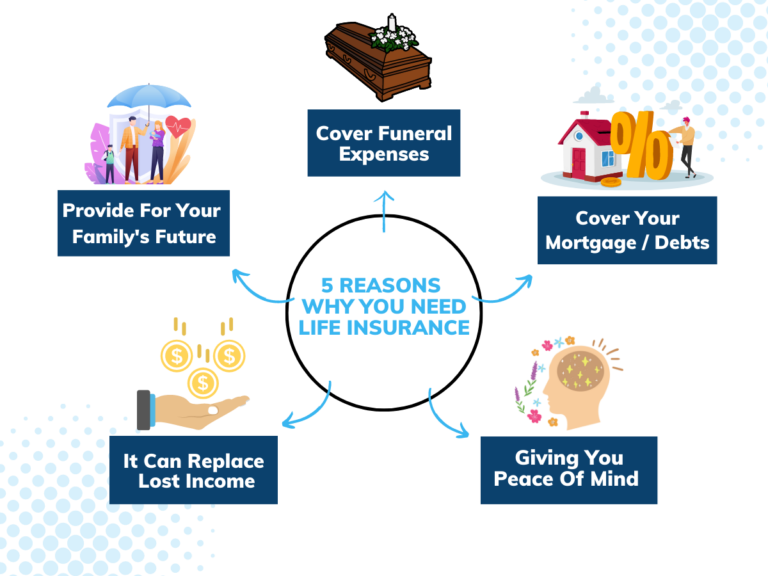

Understand the Purpose of Life Insurance

Before conducting a life insurance review, it’s important to understand the purpose of life insurance. Life insurance is designed to provide financial support to your loved ones in the event of your death. It can help cover expenses such as funeral costs, outstanding debts, and living expenses. Life insurance can also provide a source of income for your family if you were the primary breadwinner. Understanding the purpose of life insurance can help you determine if your current policy is still meeting your needs.

Evaluate Your Coverage Needs

When evaluating your coverage needs, it’s important to take a comprehensive approach. Start by assessing your current financial situation, including your income, expenses, and any outstanding debts or mortgages. Consider how much money your loved ones would need to maintain their current standard of living if you were to pass away unexpectedly. You may also want to factor in any future expenses.

A lot of people that have a life insurance policy don’t have the correct cover in place, this could be because they haven’t reviewed their policy when their situation may have changed. We always make sure to give our clients an annual call to review their policy to make sure their circumstances haven’t changed since taking out their policy.

Reviewing Your Current Policy.

The first step in conducting a life insurance review is to review your current policy. This includes understanding the type of policy you have, the coverage amount, and the premium you are paying. You should also review any riders or additional benefits that may be included in your policy. It’s important to ensure that your policy is still meeting your needs and that you are not overpaying for cover you no longer require.

Consider Your Beneficiaries.

When conducting a life insurance review, it’s important to consider who your beneficiaries are and if they have changed since you first purchased your policy. Your beneficiaries are the individuals who will receive the death benefit from your policy in the event of your passing. Normally people would have their children as their beneficiaries. However, if you don’t have any children it would be your partner or anyone who relies on you financially. Make sure that your beneficiaries are up-to-date and accurately reflect your current wishes. If you have had any major life changes, such as a divorce or the birth of a child, you may need to update your beneficiaries accordingly.

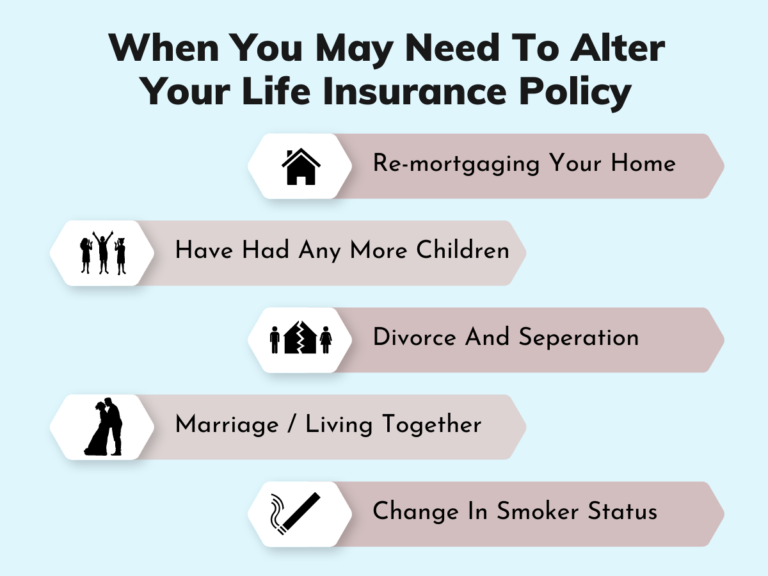

Re-mortgaging your home

Firstly, if you alter your current mortgage, it is wise to review your cover. Your policy would need updating, particularly, if there are any alterations to the amount or duration of your mortgage.(1). This overall, ensures that you’re covered for the correct amount and the right term. This is really important especially if you have changed the mortgage type from interest only to a repayment mortgage (Vice versa).

Financial dependants

Secondly, you should review your cover to ensure that your dependents receive the correct amount, if you pass. Surprisingly, a lot of people have more children and forget to review their cover. Meaning the benefit amount and term of the cover would be less than the necessary amount. This could cause financial stress for your family if you were to pass. Reviewing your policy to make sure you have the correct figures in place to protect your family will give you peace of mind knowing they’ll be able to live the same lifestyle that you provided them before you passed.

Divorce and separation

Thirdly, if you are going through a divorce or separation, your policy will need a review. (2) Especially, if it is a joint policy or you want to change the trust forms. To guarantee that the right recipients are receiving the benefit amount, a review would need to take place.

Marriage / Living together

You might want to review and change your life insurance coverage if you and your significant other manage your finances together. (3) This is to financially support them in the event of your death. Due to being dependent on one another, you may need to lengthen the policy’s term or change the benefit amount.

Change in smoker status

Finally, if you’ve not touched a nicotine product in more than 12 months, some insurance companies will classify you as a non-smoker. (4). Meaning if you review your policy, you might see a significant decrease in the premiums you’ll pay each month. Hence, why we tell our clients how important it is to review their policy when you know there has been a change in circumstances.

References-

- https://www.legalandgeneral.com/insurance/life-insurance/guides/do-you-need-life-insurance-for-a-mortgage/

- https://www.legalandgeneral.com/insurance/life-insurance/family/life-insurance-after-divorce/

- https://www.zurich.co.uk/magazine/single-or-joint-life-insurance

- https://www.legalandgeneral.com/existing-customers/life-cover-support/#/path/Channelling-Rules-Non-form-/Call-CS-/1348240462/My-smoker-status-has-changed-does-this-affect-my-policy.htm

No Comments