What Is Mortgage Protection Life Insurance?

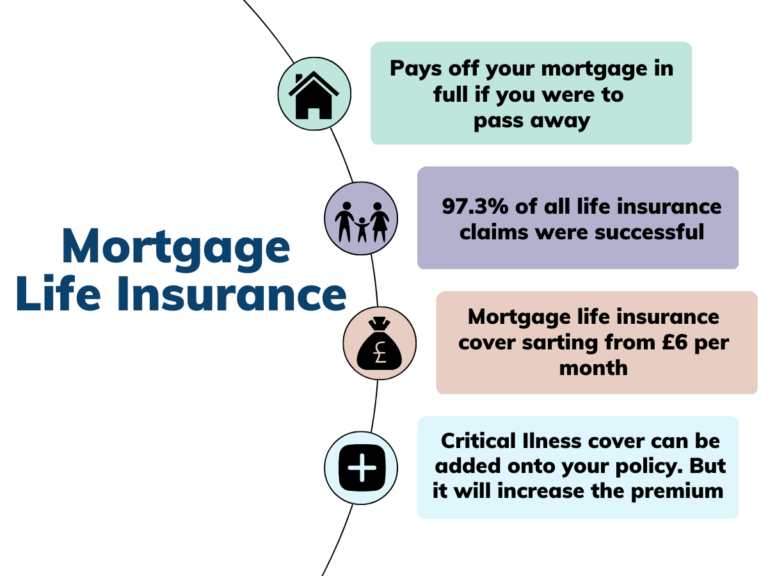

- Mortgage protection pays off your mortgage in full if you were to pass.

- Protects your loved ones from inheriting the debt of your mortgage in the event of your death.

- Protection starting from £6* a month.

- Covers interest only and repayment mortgages.