03 May Life Insurance Advice

Life Insurance Advice

- Life insurance provides a lump sum to your loved ones if you were to pass away.

- Life insurance can help your family live their current lifestyle in the event of your death.

- Term life insurance starting from £5* a month

- Tailored protection to meet your needs.

Need Life Insurance Advice?

Life insurance is an important financial tool that can provide peace of mind and financial security for your loved ones in the event of your unexpected death. However, with so many policy options and coverage amounts to choose from, it can be overwhelming to navigate the world of life insurance. That is why we have created this guide to provide some life insurance advice on how to choose the right policy and coverage amount for your needs. We understand people like to do their own research before talking to an adviser, and that is completely fine, so here is some information about picking the right policy for your situation.

Understand the Different Types of Life Insurance Policies.

Before you can choose the right life insurance policy for your needs, it’s important to understand the different types of policies available. The two main types of life insurance policies are term life insurance and whole of life insurance. Term life insurance provides coverage for a specific period, while whole of life insurance provides coverage for the duration of your life. Within these two categories, there are various subtypes of policies that offer different benefits and features. It’s important to carefully consider your needs and goals before choosing a policy.

Term life insurance is typically the most affordable option and is ideal for those who need coverage for a specific period, such as until their children are grown or until a mortgage is paid off. Whole of life insurance, on the other hand, is more expensive but offers lifelong coverage. Our advisers will be able to recommend exactly what type of policy you need in place and why you need that cover with some free life insurance advice. Remember, the right life insurance policy can provide peace of mind and financial security for you and your loved ones.

Know How Much Coverage You Need

While it’s important to consider paying off major debts like a mortgage, it’s also crucial to think about long-term needs such as supporting a spouse or partner, covering bills and providing for your children. Taking these factors into account can help ensure that your loved ones are financially secure in the event of your passing. When it comes to life insurance, there is no one-size-fits-all solution. While a common rule of thumb is to have a policy with a death benefit equal to 10 times your annual salary, your individual circumstances may require a different approach.

It’s important to seek life insurance advice from a protection adviser who can help you determine the appropriate amount of coverage for your specific needs. With our expertise, you can feel confident that you have the right amount of protection for yourself and your loved ones. We always make sure that we explain life insurance advice in full detail. This is because when we recommend a specific policy, we want you to understand exactly why the policy matches your specific needs.

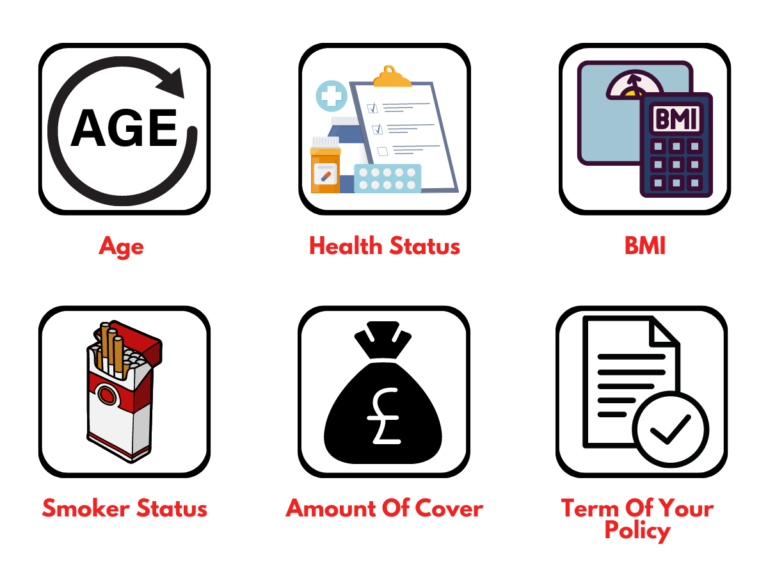

What determines the cost of life insurance?

Age

Term

Lifestyle

Sum assured

Smoker Status

Medical History

Understand What Affects Your Life Insurance Rate

When it comes to life insurance, your age and health are the two most important factors that determine your premium. Generally, the younger you are when you purchase a policy, the lower your premium will be. This is because younger individuals are typically healthier and less likely to develop health issues that could increase their risk to the insurer. So, if you’re considering purchasing life insurance, it’s best to do it sooner rather than later to lock in a lower rate.

When it comes to life insurance, there are a few key factors that can impact the cost of your policy. The type of policy you choose, such as term life insurance, can affect your premium, as can the amount of the death benefit. Additionally, the length of the term you select can also impact the rate you pay. It’s important to consider all of these factors when choosing a life insurance policy. With our free advice, we can help you make an informed decision.

When it comes to life insurance, it’s important to consider your long-term needs and goals. If you can’t afford a permanent life insurance policy right now, don’t worry. Many term life policies offer the option to convert to permanent life insurance later on. This means you can start with a more affordable term policy and switch to a permanent policy if your financial situation improves. It’s a great way to lock in a low rate now and still have the option for more comprehensive coverage in the future.

Be Truthful on the Application

When applying for life insurance, it’s crucial to be completely honest and transparent about your personal information. Even if you think a certain detail may negatively impact your chances of getting approved or affect your premium rates, it’s important to disclose it. Insurance companies have ways of verifying the information you provide, so any inaccuracies could result in your policy being voided or denied. So, always remember to be truthful and upfront when applying for life insurance.

When considering life insurance, it’s important to understand that the insurance company will gather information about you in order to assess your risk level. This information may include your medical records, prescription drug history and general lifestyle questions. It’s important to be honest and transparent during this process to ensure that you receive accurate coverage and avoid any potential issues down the line. If you lied on your application, the insurance company will not pay out any money to your family. If you have any medical complications, let our advisers know, and they will do their best to help you get insured.

Consider Your Budget.

When it comes to making a choice about life insurance, it’s not just about numbers; it’s about securing a future for your loved ones. While the allure of lower premiums may be strong, it’s crucial to balance your budget with the level of protection your family truly deserves in the event of the unexpected.

Don’t be lured by policies that start with deceptively low premiums, only to spring unwelcome surprises in the long run. We’re here to guide you through this maze of choices. As financial advisors, we excel in finding the sweet spot where your budget aligns perfectly with the necessary coverage. The result? Total peace of mind, knowing that your family’s financial safety net is ready for any challenge life may throw your way.

Don't Just Focus on Premium

When it comes to life insurance, it’s important to find a policy that fits your budget. But don’t make the mistake of solely focusing on the price. Consider factors such as the coverage amount, the length of the policy, and the reputation of the insurance company. All of the companies that we work with are 5-star Defaqto insurance providers. It’s also a good idea to review your policy regularly to ensure it still meets your needs and to make any necessary adjustments. At Carew & Co., we make sure to give our clients follow up calls every year to make sure their policy is still correct for their situation and advise them on any adjustments that may be needed.

Our advice is always free of charge and we make sure that the insurance you have in place is protecting you fully. That is why we always give you an annual call to review everything you have in place. Even if your situation has changed, we can help advise you and find the right policy.

When it comes to purchasing life insurance, it’s important to consider more than just the premium you’ll be paying. When it comes to choosing a life insurance provider, we will show you a list of the different 5-star defaqto providers that we work with and let you know about all the benefits that each company provides. Then it is up to you to decide which company you would like to be insured with after reviewing all the information we have provided you with.

Review and Update Your Policy Regularly.

It’s important to review and update your life insurance policy regularly to ensure that it still meets your needs. Life changes such as marriage, divorce, the birth of a child, or a change in employment can all impact your coverage needs. Additionally, as you age, your coverage needs may change. That is why we stay in contact with all of our clients to make sure that every year their policy is reviewed by one of our advisers.

Let Us Help You Protect Your Income

Cover your family from as little as £6* a month

No Comments